Full resolution of the landscape can be found here

Motivation

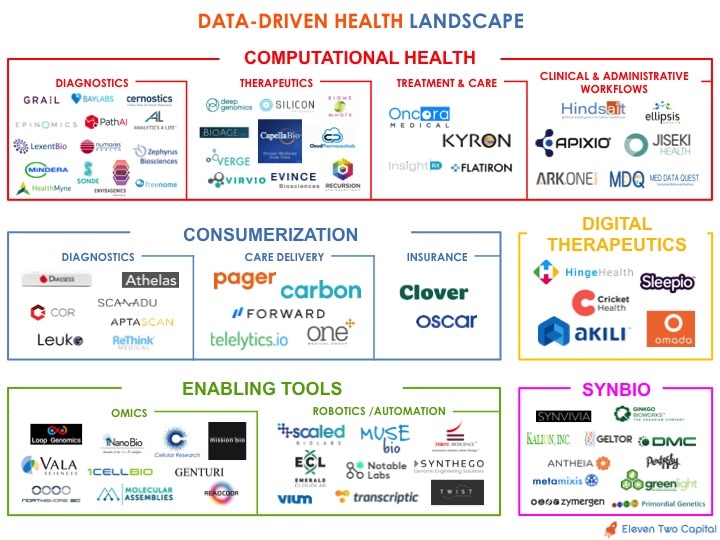

We have seen a revolution in the healthcare industry in recent years – ehealth to mhealth, influx of genomic data, and the Affordable Care Act just to name a few. Our fund, 11.2 Capital, has invested in a number of breakthrough technology companies in this revolution. We wanted to organize thoughts in the following investment areas, reflect on how we see them unfold, and understand the opportunities for innovation that will drive the future of healthcare.

As a non-traditional healthcare investor, we look for companies capitalizing on the confluence of trends transforming the healthcare industry and solving meaningful problems with core technologies. For now, we are broadly calling this space “Data-Driven Health,” but our interest and investment encompass innovations that lie beyond the title.

Investment areas and companies in the landscape

1. Computational Health

Computational health combines availability of more data and advances in software/hardware technologies to solve problems in healthcare with computation-based approaches. The explosion in volume of various kinds of data – genomic, transcriptomic, proteomic, epigenetic, metabolomic, microbiome, clinical, and behavioral – is driven by the lowering cost of data acquisition and storage. For example, sequencing a human genome used to cost around $3 billion in the 90’s. Today it only costs a few thousand dollars – a faster decline than what we observed in computing cost depicted by Moore’s Law. In addition, advances in software and hardware technologies are rapidly accelerating, particularly around artificial intelligence.

The confluence of these trends is transforming healthcare, and companies are harnessing data and applying AI to solve meaningful problems in diagnostics, therapeutics, treatment & care, and clinical & administrative workflows. In diagnostics, Bay Labs is applying deep learning to ultrasound imaging, to help with both acquisition and interpretation of echocardiograms. Grail and Freenome are developing blood screening tests and novel computation methods to detect cancer early. In therapeutics, Auransa has developed a computational platform that characterizes disease heterogeneity and identifies compounds that will be effective for specific patient sub-populations. Deep Genomics is building a number of machine learning modules to interpret genetic variations and how they impact various biological processes, such as splicing, in the body, discovering new drug targets for nucleic acid therapeutics. In treatment & care, companies like Flatiron Health and Oncora Medical are helping physicians use historical clinical data to make better treatment decisions for patients today.

As multi-morbid patients continue to grow in volume and make up ever more of the cost of care provided, hospitals are increasingly forced to seek cost-effective, proactive, multi-touch methods to manage these patients. Companies such as Apixio enables Medicare Advantage plans to more accurately adjust risk based on patient records, and Hindsait enables payors to speed up important decisions such as prior authorizations to reduce unnecessary services. Ark One and Biome Analytics fuse multiple data sources to reveal drivers of cost and quality so that clinical teams can deliver the best possible care at the lowest cost. Outside the hospital, we see smart care coordination platforms prevent costly acute care readmissions which account for the bulk of healthcare cost. Ellipsis Health is helping care coordinators detect signs of mental disorders such as depression through automated patient voice analysis, enabling the clinician to kick-off depression protocols potentially even before patients themselves are aware of their depression. Jiseki Health is transforming care coordination by taking on risks themselves to provide social services (for example, food, transportation) to Medicare and Medicaid patients in a patient’s community.

We believe that the influx of data from the molecular to behavioral level will provide unprecedented insight into diagnosis and treatment of diseases. The interdisciplinary nature of computational health presents innovation and partnership opportunities for nimble startups. We are now at the early stage of data collection and discovery: We are still discovering new insights about our genome every day and we still know very little about our epigenome and proteome. We are excited to be in the middle of this discovery and are hopeful that this understanding will one day enable us to create a detailed molecular atlas of our body that simulates changes based on various diseases and changes in the environment. In addition, we see opportunities in technologies that help hospitals effectively deploy increasingly costly labor resources and meaningfully reduce supply cost, predict acute events, ensure delivery of care in the most appropriate setting, and enhance patient experience and health outcomes for an ever older, sicker, and more complex population. The challenges facing healthcare providers and payers are significant and so are the opportunities for innovative companies with effective solutions. By computing health, we can design treatments that are targeted, precise, and uniquely suited for individuals.

2. Enabling Tools

We are continuing to see innovations in the tools space that will enable cheaper and faster access to data across the genome, epigenome, transcriptome, proteome, epigenome, metabolome, microbiome, etc. For example, Loop Genomics is developing a sample preparation technology that will enable long read sequencing with existing Illumina instruments. Genturi is developing a nanofluidic device that will enable cheaper and faster access to structural variants up to chromosome-length in a genome. In epigenetics, companies such as Epinomics and Genome Profiling are developing genome-wide methylation and histone-modification profiling platforms.

We are also seeing companies adding dimensions and contexts to the omics data. For example, Readcoor is commercializing a spatial gene sequencing technology that simultaneously reads RNA sequences and visualizes their 3D coordinates within whole cells and tissues. Single-cell analysis is particularly important in cancer where bulk analyses miss rare cells and cell heterogeneity. For such analysis, Cellular Research is working on gene expression, and Zephyrus is working with proteomic data.

Besides reading DNA, writing (DNA synthesis) and editing are equally important in basic biological research, biofuels, agriculture, drug discovery, and gene therapy. Molecular Assemblies is developing an enzymatic method to write long, high-fidelity, and cost-effective DNA to accelerate the emerging precision medicine and synthetic biology fields. In genome editing, CRISPR has revolutionized the space by providing a cost-effective, multiplex molecular tool to edit almost any genome of choice. Due to its high precision and accessibility, researchers are expanding its use to gene silencing and activation.

In addition to innovations in the reading and writing of omics data, life sciences experiments are moving toward the cloud and automation to increase efficiency. As an active tech investor in robotics (Cruise Automation, Savioke, Kindred), we are excited by companies bringing robotics and automation to research tools. For example, companies such as Emerald Cloud Labs and Transcriptic are both providing robotic cloud labs, so any researcher can run experiments remotely. Similarly, Vium is providing rodent cages equipped with sensors and high-definition cameras, among other technology, so researchers can run animal experiments remotely. Companies such as Twist, Gen9, and Synthego are applying large-scale automation to make DNA and RNA synthesis cheaper and higher quality. Notable Labs is offering a high-throughput robotics platform to screen drug combinations that will work best on individual cancer patients. Thrive Bioscience is developing a counter-top instrument to fully automate cell culturing. All these companies provide tools and services to make life sciences R&D more efficient by automating certain processes that are currently manual and error prone.

As we continue to see development of tools to access and analyze multi-omics data in a high-throughput and cost-effective way, we are optimistic that these innovations will be incorporated into clinical care, improving how omics data is currently enabling precision medicine. With robotics and automation, experiments will be conducted in a cheaper, faster, and more reproducible manner, fueling scientific discovery and clinical translation.

3. Consumerization

With health information and education ever more accessible, patients are increasingly taking an active role in their care experience, creating “consumerization” of healthcare, manifested across diagnostics, care delivery, and insurance. In diagnostics, Diassess is developing a portable, disposable device for pathogen detection. The idea is to market this first in point-of-care settings and eventually over the counter, allowing consumers to test for infectious diseases at home. There are many other examples of consumerization of diagnostics, including Scanadu, Cor, and Cue, which are bringing vital sign monitoring, urine analysis, blood chemistry, and other diagnostics directly into the home. In care delivery, One Medical has built a consumer-friendly primary care network, Pager allows consumers can summon doctors on demand, and Forward uses new technology to create a baseline of personal health data, with AI-assisted follow-ups. Even in the insurance industry, companies such as Clover Health and Oscar Health are both providing more consumer-friendly health insurance plans that better serve the needs of different patient populations.

Point of care and home-based diagnostics will increasingly enable consumers to find out about their conditions in a setting of their choice, rather than waiting days for results, while decreasing unnecessary emergency department admissions and even visits to general practitioners. A recent survey conducted by Silicon Valley Bank found that patient and clinical adoption remain the biggest industry challenge. We are excited about diagnostics moving toward being less invasive and more accessible, combining analytics and what’s measurable to accurately infer health vitals.

4. Digital Therapeutics

From small-molecules to biologics to immunotherapy in therapeutic innovation, we believe that digital therapeutics is one of the treatment paradigms, especially in the field of behavior-mediated conditions. Companies are digitalizing care in pre-diabetes, diabetes, heart disease, kidney disorders, sleep, and various types of psychological disorders, with the shared goal of cost-effective disease management and treatment. Hinge Health is digitizing the delivery of best practice care of musculoskeletal disorders, one of the top three cost drivers for self-insured employers. Results from early pilots show that participants see a reduction in pain and desire for surgery, helping employers save costs. Pharmaceutical companies are taking notice in digital therapeutics and working more closely with startups to develop “beyond the pill” approach to patient health. Akili Interactive has partnered with Pfizer to measure the effectiveness of their digital game to slow down the progression of Alzheimer’s. Amgen has a digital health focus that aims to increase drug adherence. We see these non-traditional partnerships will continue to grow.

Our country is the most-drugged country in the world, increasing cost of care as well as experienced side effects and toxicities from pharmaceutical drugs. Digital therapeutics serves as an effective and safe alternative to this epidemic. We’ve seen successful companies focus on strong marketing, seamless integration into the patient-provider workflow, and deep understanding of various types of markets in care provisioning. As core technology investors, we believe that digital therapeutic companies with a defensible and effective approach will create long lasting impact on patient health.

5. Synbio

Engineering biological systems is not a new field, but our increasing understanding of biology at the cellular level has enabled us to more effectively manipulate organisms to perform certain functions and create valuable products. We saw a wave of biofuel companies come and go, but newer entrants are seeing market demand from high-value products. For example, Ginkgo Bioworks is on the forefront of engineering microbes to produce flavors and fragrances at a cheaper cost than traditional methods. Antheia is engineering yeast to make opioids, and Geltor has created a microbe that cost effectively manufactures collagen.

As we collect an increasing amount of molecular data, we continue to look for ways to gain new insights into the functions by leveraging bioinformatics and machine learning. We can then extract and apply useful gene functions to various industries.

----------

Precision medicine is here to stay and it requires companies to have the biology, engineering, data science, and clinical talent to solve meaningful problems. We’d love to talk to anyone using an interdisciplinary approach to better our health. We hope to continue this conversation and welcome feedback if there are categories or companies missing. Drop us a note at yizhen[at]eleventwocap.com or shelley[at]eleventwocap.com. Thank you to Chris Armstrong, Zavain Dar, Scott Barclay and many others for sharing your perspectives.

About 11.2 Capital

11.2 Capital is an early stage venture capital fund based in San Francisco, investing in breakthrough technology in artificial intelligence, AR/VR, robotics, space, and data-driven health. 11.2 Capital is an investor in Bay Labs, Auransa, Deep Genomics, Loop Genomics, Genturi, Molecular Assemblies, Notable Labs, Diassess, Hinge Health, and Ginkgo Bioworks.

We have seen a revolution in the healthcare industry in recent years – ehealth to mhealth, influx of genomic data, and the Affordable Care Act just to name a few. Our fund, 11.2 Capital, has invested in a number of breakthrough technology companies in this revolution. We wanted to organize thoughts in the following investment areas, reflect on how we see them unfold, and understand the opportunities for innovation that will drive the future of healthcare.

As a non-traditional healthcare investor, we look for companies capitalizing on the confluence of trends transforming the healthcare industry and solving meaningful problems with core technologies. For now, we are broadly calling this space “Data-Driven Health,” but our interest and investment encompass innovations that lie beyond the title.

Investment areas and companies in the landscape

1. Computational Health

Computational health combines availability of more data and advances in software/hardware technologies to solve problems in healthcare with computation-based approaches. The explosion in volume of various kinds of data – genomic, transcriptomic, proteomic, epigenetic, metabolomic, microbiome, clinical, and behavioral – is driven by the lowering cost of data acquisition and storage. For example, sequencing a human genome used to cost around $3 billion in the 90’s. Today it only costs a few thousand dollars – a faster decline than what we observed in computing cost depicted by Moore’s Law. In addition, advances in software and hardware technologies are rapidly accelerating, particularly around artificial intelligence.

The confluence of these trends is transforming healthcare, and companies are harnessing data and applying AI to solve meaningful problems in diagnostics, therapeutics, treatment & care, and clinical & administrative workflows. In diagnostics, Bay Labs is applying deep learning to ultrasound imaging, to help with both acquisition and interpretation of echocardiograms. Grail and Freenome are developing blood screening tests and novel computation methods to detect cancer early. In therapeutics, Auransa has developed a computational platform that characterizes disease heterogeneity and identifies compounds that will be effective for specific patient sub-populations. Deep Genomics is building a number of machine learning modules to interpret genetic variations and how they impact various biological processes, such as splicing, in the body, discovering new drug targets for nucleic acid therapeutics. In treatment & care, companies like Flatiron Health and Oncora Medical are helping physicians use historical clinical data to make better treatment decisions for patients today.

As multi-morbid patients continue to grow in volume and make up ever more of the cost of care provided, hospitals are increasingly forced to seek cost-effective, proactive, multi-touch methods to manage these patients. Companies such as Apixio enables Medicare Advantage plans to more accurately adjust risk based on patient records, and Hindsait enables payors to speed up important decisions such as prior authorizations to reduce unnecessary services. Ark One and Biome Analytics fuse multiple data sources to reveal drivers of cost and quality so that clinical teams can deliver the best possible care at the lowest cost. Outside the hospital, we see smart care coordination platforms prevent costly acute care readmissions which account for the bulk of healthcare cost. Ellipsis Health is helping care coordinators detect signs of mental disorders such as depression through automated patient voice analysis, enabling the clinician to kick-off depression protocols potentially even before patients themselves are aware of their depression. Jiseki Health is transforming care coordination by taking on risks themselves to provide social services (for example, food, transportation) to Medicare and Medicaid patients in a patient’s community.

We believe that the influx of data from the molecular to behavioral level will provide unprecedented insight into diagnosis and treatment of diseases. The interdisciplinary nature of computational health presents innovation and partnership opportunities for nimble startups. We are now at the early stage of data collection and discovery: We are still discovering new insights about our genome every day and we still know very little about our epigenome and proteome. We are excited to be in the middle of this discovery and are hopeful that this understanding will one day enable us to create a detailed molecular atlas of our body that simulates changes based on various diseases and changes in the environment. In addition, we see opportunities in technologies that help hospitals effectively deploy increasingly costly labor resources and meaningfully reduce supply cost, predict acute events, ensure delivery of care in the most appropriate setting, and enhance patient experience and health outcomes for an ever older, sicker, and more complex population. The challenges facing healthcare providers and payers are significant and so are the opportunities for innovative companies with effective solutions. By computing health, we can design treatments that are targeted, precise, and uniquely suited for individuals.

2. Enabling Tools

We are continuing to see innovations in the tools space that will enable cheaper and faster access to data across the genome, epigenome, transcriptome, proteome, epigenome, metabolome, microbiome, etc. For example, Loop Genomics is developing a sample preparation technology that will enable long read sequencing with existing Illumina instruments. Genturi is developing a nanofluidic device that will enable cheaper and faster access to structural variants up to chromosome-length in a genome. In epigenetics, companies such as Epinomics and Genome Profiling are developing genome-wide methylation and histone-modification profiling platforms.

We are also seeing companies adding dimensions and contexts to the omics data. For example, Readcoor is commercializing a spatial gene sequencing technology that simultaneously reads RNA sequences and visualizes their 3D coordinates within whole cells and tissues. Single-cell analysis is particularly important in cancer where bulk analyses miss rare cells and cell heterogeneity. For such analysis, Cellular Research is working on gene expression, and Zephyrus is working with proteomic data.

Besides reading DNA, writing (DNA synthesis) and editing are equally important in basic biological research, biofuels, agriculture, drug discovery, and gene therapy. Molecular Assemblies is developing an enzymatic method to write long, high-fidelity, and cost-effective DNA to accelerate the emerging precision medicine and synthetic biology fields. In genome editing, CRISPR has revolutionized the space by providing a cost-effective, multiplex molecular tool to edit almost any genome of choice. Due to its high precision and accessibility, researchers are expanding its use to gene silencing and activation.

In addition to innovations in the reading and writing of omics data, life sciences experiments are moving toward the cloud and automation to increase efficiency. As an active tech investor in robotics (Cruise Automation, Savioke, Kindred), we are excited by companies bringing robotics and automation to research tools. For example, companies such as Emerald Cloud Labs and Transcriptic are both providing robotic cloud labs, so any researcher can run experiments remotely. Similarly, Vium is providing rodent cages equipped with sensors and high-definition cameras, among other technology, so researchers can run animal experiments remotely. Companies such as Twist, Gen9, and Synthego are applying large-scale automation to make DNA and RNA synthesis cheaper and higher quality. Notable Labs is offering a high-throughput robotics platform to screen drug combinations that will work best on individual cancer patients. Thrive Bioscience is developing a counter-top instrument to fully automate cell culturing. All these companies provide tools and services to make life sciences R&D more efficient by automating certain processes that are currently manual and error prone.

As we continue to see development of tools to access and analyze multi-omics data in a high-throughput and cost-effective way, we are optimistic that these innovations will be incorporated into clinical care, improving how omics data is currently enabling precision medicine. With robotics and automation, experiments will be conducted in a cheaper, faster, and more reproducible manner, fueling scientific discovery and clinical translation.

3. Consumerization

With health information and education ever more accessible, patients are increasingly taking an active role in their care experience, creating “consumerization” of healthcare, manifested across diagnostics, care delivery, and insurance. In diagnostics, Diassess is developing a portable, disposable device for pathogen detection. The idea is to market this first in point-of-care settings and eventually over the counter, allowing consumers to test for infectious diseases at home. There are many other examples of consumerization of diagnostics, including Scanadu, Cor, and Cue, which are bringing vital sign monitoring, urine analysis, blood chemistry, and other diagnostics directly into the home. In care delivery, One Medical has built a consumer-friendly primary care network, Pager allows consumers can summon doctors on demand, and Forward uses new technology to create a baseline of personal health data, with AI-assisted follow-ups. Even in the insurance industry, companies such as Clover Health and Oscar Health are both providing more consumer-friendly health insurance plans that better serve the needs of different patient populations.

Point of care and home-based diagnostics will increasingly enable consumers to find out about their conditions in a setting of their choice, rather than waiting days for results, while decreasing unnecessary emergency department admissions and even visits to general practitioners. A recent survey conducted by Silicon Valley Bank found that patient and clinical adoption remain the biggest industry challenge. We are excited about diagnostics moving toward being less invasive and more accessible, combining analytics and what’s measurable to accurately infer health vitals.

4. Digital Therapeutics

From small-molecules to biologics to immunotherapy in therapeutic innovation, we believe that digital therapeutics is one of the treatment paradigms, especially in the field of behavior-mediated conditions. Companies are digitalizing care in pre-diabetes, diabetes, heart disease, kidney disorders, sleep, and various types of psychological disorders, with the shared goal of cost-effective disease management and treatment. Hinge Health is digitizing the delivery of best practice care of musculoskeletal disorders, one of the top three cost drivers for self-insured employers. Results from early pilots show that participants see a reduction in pain and desire for surgery, helping employers save costs. Pharmaceutical companies are taking notice in digital therapeutics and working more closely with startups to develop “beyond the pill” approach to patient health. Akili Interactive has partnered with Pfizer to measure the effectiveness of their digital game to slow down the progression of Alzheimer’s. Amgen has a digital health focus that aims to increase drug adherence. We see these non-traditional partnerships will continue to grow.

Our country is the most-drugged country in the world, increasing cost of care as well as experienced side effects and toxicities from pharmaceutical drugs. Digital therapeutics serves as an effective and safe alternative to this epidemic. We’ve seen successful companies focus on strong marketing, seamless integration into the patient-provider workflow, and deep understanding of various types of markets in care provisioning. As core technology investors, we believe that digital therapeutic companies with a defensible and effective approach will create long lasting impact on patient health.

5. Synbio

Engineering biological systems is not a new field, but our increasing understanding of biology at the cellular level has enabled us to more effectively manipulate organisms to perform certain functions and create valuable products. We saw a wave of biofuel companies come and go, but newer entrants are seeing market demand from high-value products. For example, Ginkgo Bioworks is on the forefront of engineering microbes to produce flavors and fragrances at a cheaper cost than traditional methods. Antheia is engineering yeast to make opioids, and Geltor has created a microbe that cost effectively manufactures collagen.

As we collect an increasing amount of molecular data, we continue to look for ways to gain new insights into the functions by leveraging bioinformatics and machine learning. We can then extract and apply useful gene functions to various industries.

----------

Precision medicine is here to stay and it requires companies to have the biology, engineering, data science, and clinical talent to solve meaningful problems. We’d love to talk to anyone using an interdisciplinary approach to better our health. We hope to continue this conversation and welcome feedback if there are categories or companies missing. Drop us a note at yizhen[at]eleventwocap.com or shelley[at]eleventwocap.com. Thank you to Chris Armstrong, Zavain Dar, Scott Barclay and many others for sharing your perspectives.

About 11.2 Capital

11.2 Capital is an early stage venture capital fund based in San Francisco, investing in breakthrough technology in artificial intelligence, AR/VR, robotics, space, and data-driven health. 11.2 Capital is an investor in Bay Labs, Auransa, Deep Genomics, Loop Genomics, Genturi, Molecular Assemblies, Notable Labs, Diassess, Hinge Health, and Ginkgo Bioworks.